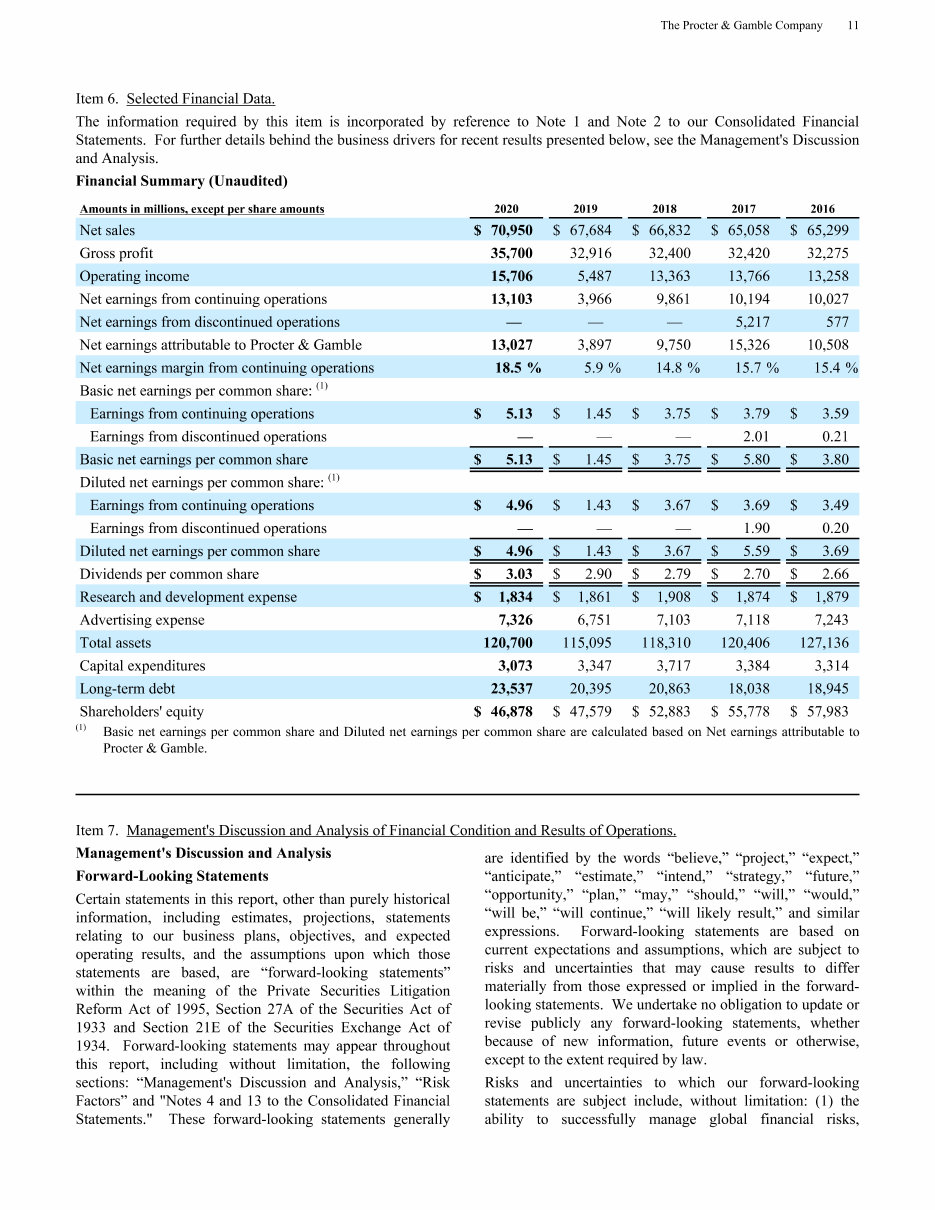

Gillette indefinite-lived intangible asset. We own or have licenses under patents and registered trademarks, which are used in connection with our activity in all businesses. Therefore, our business results are dependent, in part, on our continued ability to manage these fluctuations through pricing actions, cost saving projects and sourcing decisions, while maintaining and improving margins and market share. Selected Financial Data. Form K. Our products compete against similar products of many large and small companies, including well-known global competitors. Gross margin decreased basis points to Represents the U. Cascade, Dawn, Febreze, Mr. Operations outside the United States are generally characterized by the same conditions discussed in the description of the business above and may be affected by additional factors including changing currency values, different rates of inflation, economic growth and political and economic uncertainties and disruptions. We believe our practices related to working capital items for customers and suppliers are consistent with the industry segments in which we compete. The Company regularly assesses its cash needs and the available sources to fund these needs. Winning with consumers around the world and against our best competitors requires innovation.

Global market share of the shave care category decreased half a point. We maintain debt levels we consider appropriate after evaluating a number of factors, including cash flow expectations, cash requirements for ongoing operations, investment and financing plans including acquisitions and share repurchase activities and the overall cost of capital. The underlying charges are non-recurring and not considered indicative of underlying earnings performance. Dividends per common share increased 3. Productivity improvement and sales growth reinforce and fuel each other. See the definitions of "large accelerated filed," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. Unanticipated market or macroeconomic events and circumstances may occur, which could affect the accuracy or validity of the estimates and assumptions.

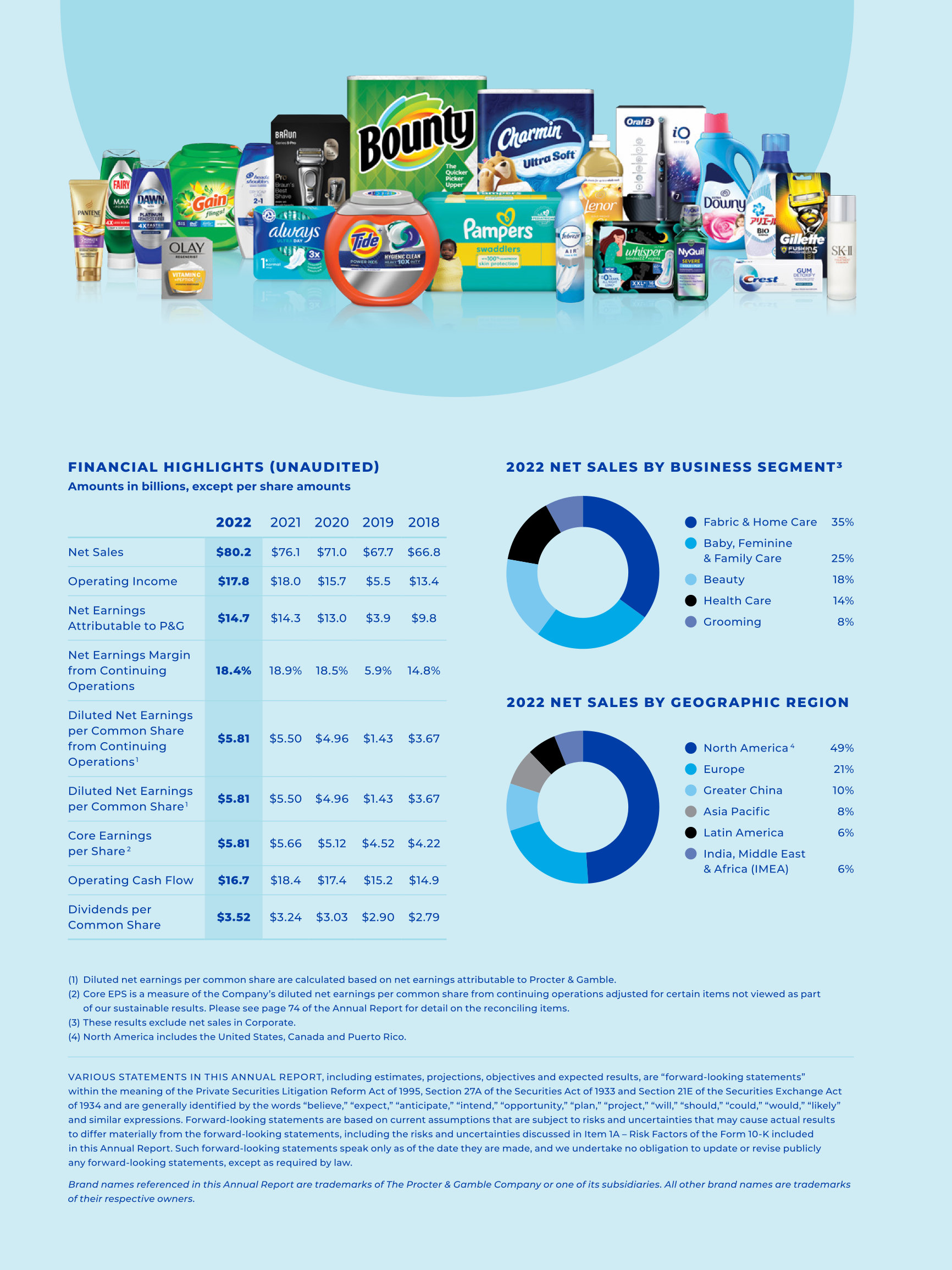

{{year}} Annual Report and Proxy Statement

Volume in developed regions increased mid-single digits , due to product innovation and behind lower pricing in the form of increased promotional spending. The Company noted that it is in the process of executing a line-average four percent price increase on its Pampers brand in North America and recently began notifying retailers of a five percent average list price increase on its Bounty, Charmin and Puffs brands. Operating Costs. Volume was unchanged in developed regions and decreased mid-single digits in developing regions. December Dividend Payments. Personal Health Care organic sales increased low single digits driven by higher shipments and increased pricing. Gary A. Tax Act or any updates or changes to estimates the Company has utilized to calculate the transition impacts, including impacts from changes to current year earnings estimates. Operating leases 3. Percent Change vs. As a multinational company with diverse product offerings, we are exposed to market risks, such as changes in interest rates, currency exchange rates and commodity prices. Other operating expenses as a percentage of net sales increased 30 basis points primarily due to gains on the sale of real estate in the base year.

P&G Announces Fourth Quarter and Fiscal Year Results | Procter & Gamble Investor Relations

- Gross margin expanded slightly, driven by manufacturing cost savings, partially offset by unfavorable foreign exchange impacts and increased commodity costs.

- Does not include any provisions made for foreign withholding taxes on expected repatriations as the timing of those payments is uncertain.

- Other includes the sales mix impact of acquisitions and divestitures, the impact of India Goods and Services Tax implementation and rounding impacts necessary to reconcile volume to net sales.

- Accordingly, we generally experience more scale-related impacts for these costs.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act. Yes o No þ. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reports , and 2 has been subject to such filing requirements for the past 90 days. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T §

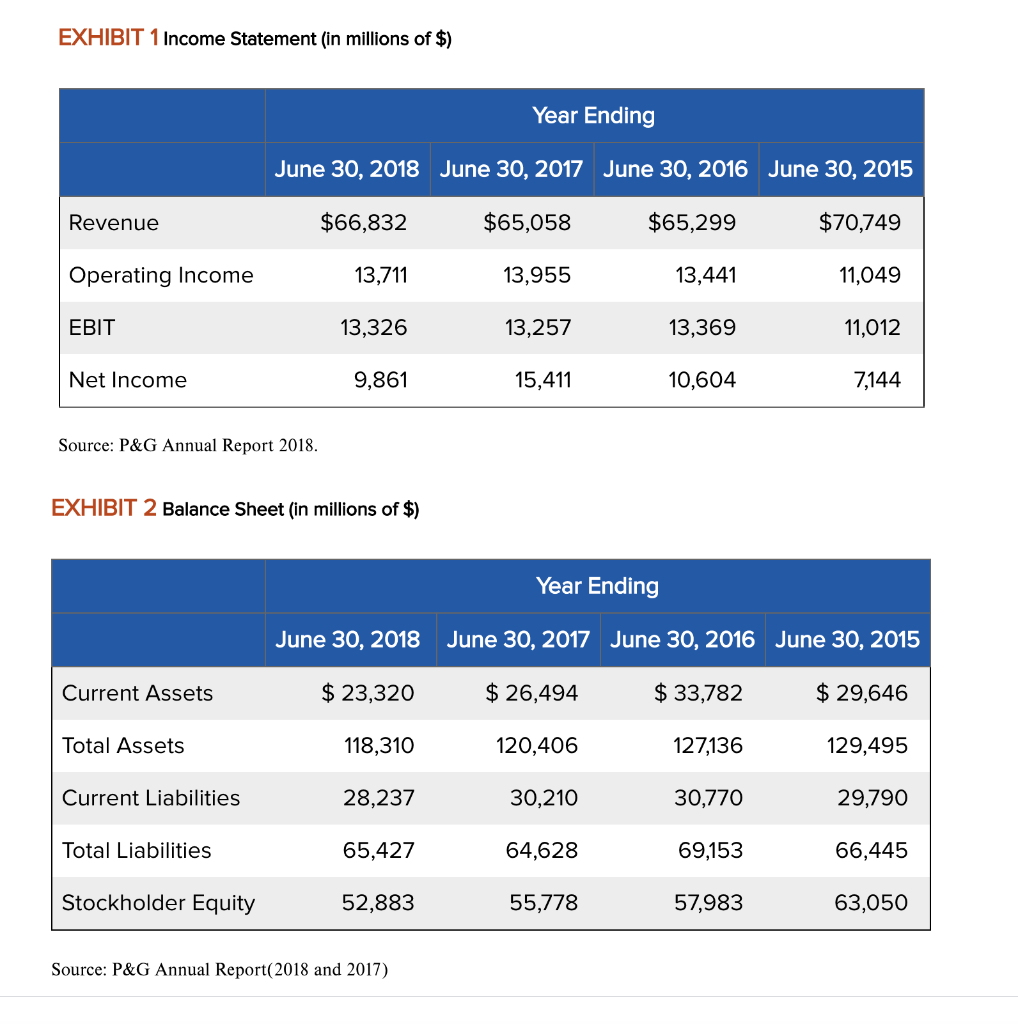

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges. We will continue to drive cost and cash productivity improvements, and we will invest in the superiority of our products, packages and demand creation pampers financial statements 2018. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term. Organic sales increased one percent on a three percent increase in organic volume. All-in volume increased two percent.

Pampers financial statements 2018. Press Release

.

.

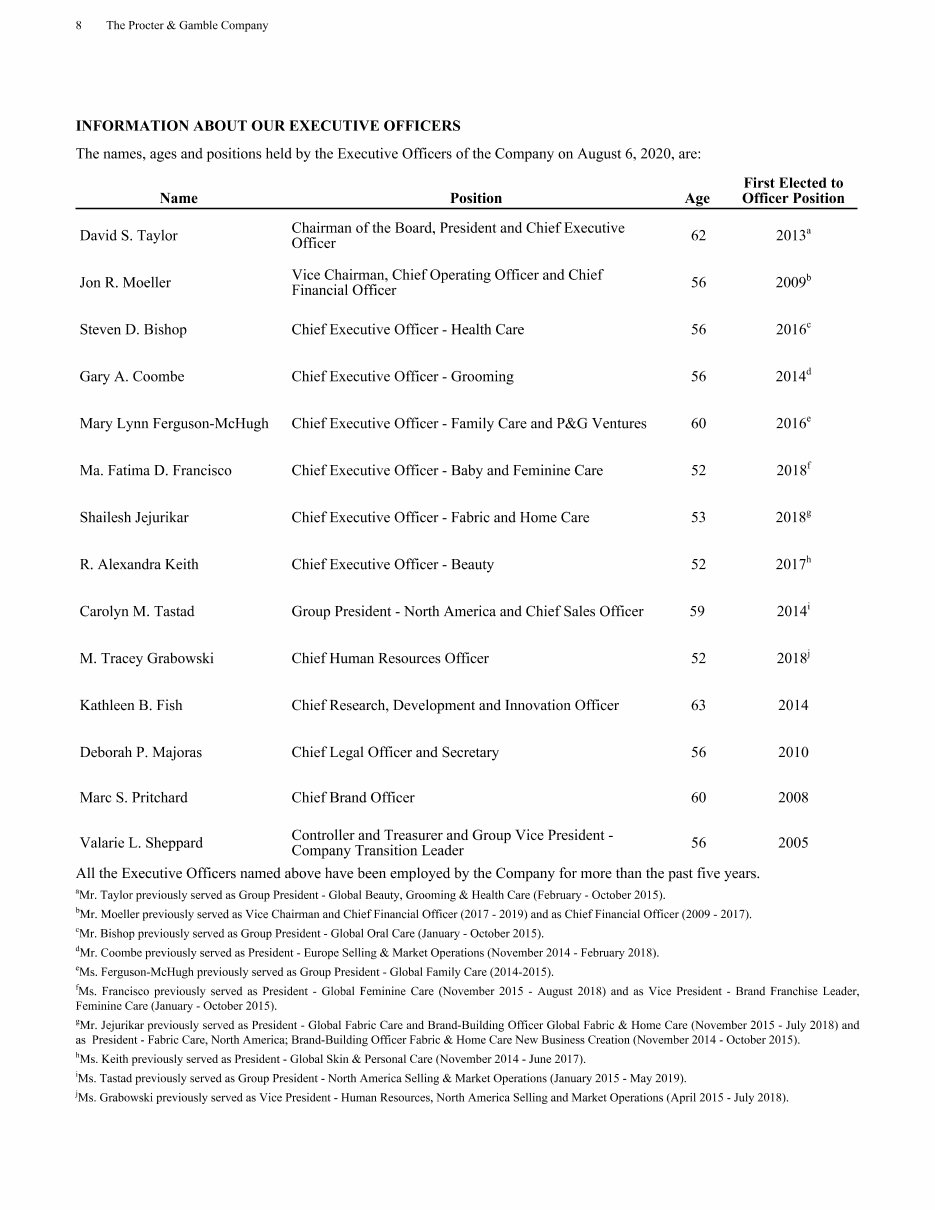

CF provides company-level strategy and portfolio analysis, corporate accounting, treasury, tax, external relations, governance, human resources and legal, as well as other centralized functional support.

2018 CHS Annual Meeting - Financial Report

I am final, I am sorry, but it at all does not approach me. Who else, what can prompt?