The bill went into effect July 1, Feminine hygiene products including tampons, sanitary napkins, menstrual cups, menstrual sponges, menstrual pads, or other similar tangible personal properties sold for the principal purpose of feminine hygiene in connection with the menstrual cycle or postpartum care. Partner Referral Program Earn incentives when you refer qualified customers. Download the Toolkit. The details of such bonus Pampers Cash will be provided at the time the offer is made. Feb 21, Who is going to pay because that is very important for us to determine the ultimate burden on whom it is going to fall under? Streamlined Sales Tax program. Avalara Tax Changes Get your copy now. The Loyalty Program and all Pampers Cash expires not later than p. Money Consumer. The Texas Comptroller has yet to publicize the tax changes, but likely will soon. Each redeeming Member is solely responsible for ensuring that their shipping or email address, as applicable, is correct in the Loyalty Program records prior to redemption.

Beverage alcohol Communications Distribution Education. Members should regularly consult the Loyalty Program website for updates about reward availability. Texas currently has what some folks call a diaper tax and a tampon tax, meaning Texas sales and use tax applies to diapers and tampons. Microsoft Dynamics. Marketplaces Products to help marketplace platforms keep up with evolving tax laws. Schedule a demo. Sales Sales and use tax Retail, ecommerce, manufacturing, software. Avalara Property Tax Automate real and personal property tax management.

Items Exempted From Texas Sales Tax Starting Sept. 1

Sales and use tax Retail, ecommerce, manufacturing, software. Failure to tax products that are taxable can lead to a significant back-tax liability for a business, plus penalties and interest. Avalara Property Tax Automate real and personal property tax management. The bill becomes law on Friday, Sept. State business licenses Licensing requirements by location. Marketplaces Products to help marketplace platforms keep up with evolving tax laws. Accountants State and local tax experts across the U. Click here for a list of other notable laws to look out for. Beginning a. Become a Certified Implementation Partner Support, online training, and continuing education. Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders. Local News. Members who participate in the Loyalty Program after the extension agree to be bound by the Terms then in effect at the time of Loyalty Program extension.

Florida's governor wants diapers, strollers, cribs to be tax-free permanently

- Indiana — Indiana passed a sales tax exemption and it went into effect July 1,

- Resource center Learn about sales and use tax, nexus, Wayfair.

- Period products, diapers, baby bottles will be tax free in Texas starting Sept.

Rebecca Salinas , Digital Journalist. Avery Everett , Multimedia Journalist. Texas lawmakers added those products under tax exemptions in Senate Bill , which was signed into law by Gov. Greg Abbott following the 88th Legislature. The bill becomes law on Friday, Sept. A bill of its kind has been pushed by Democrats for at least four legislative sessions, State Rep. Donna Howard told the Texas Tribune. It became a priority after the U. Supreme Court overturned Roe vs. Wade in June , as a way to support new mothers and fathers with the cost of supplies. Under Senate Bill , these items will be exempt from taxes:. The tax exemption applies to items purchased online. SB is one of more than bills going into effect on Sept. Click here for a list of other notable laws to look out for. Avery is a Philadelphia native. Local News. Period products, diapers, baby bottles will be tax free in Texas starting Sept. Published: August 31, , AM.

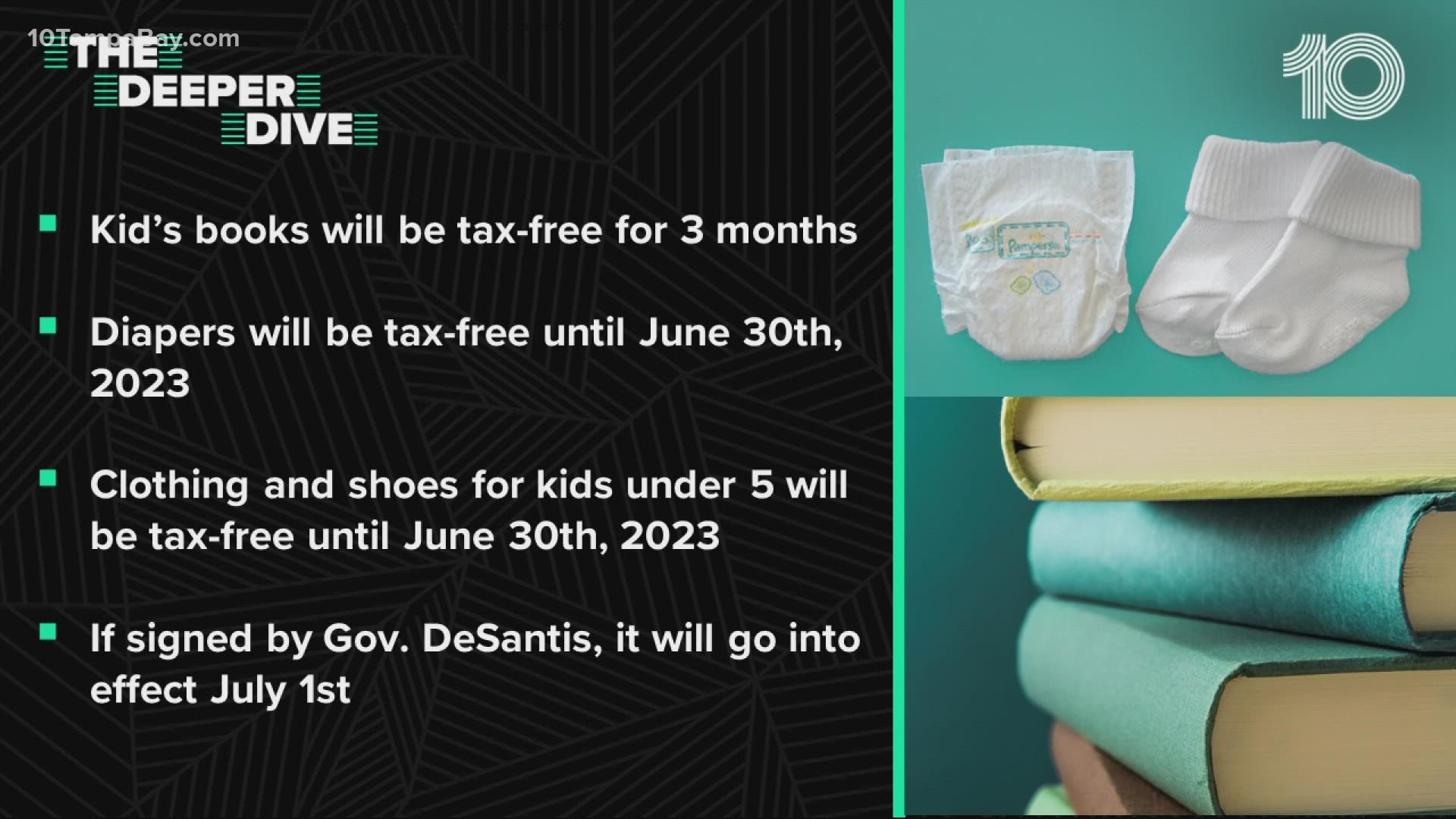

The governor is proposing a permanent sales tax exemption on baby necessities like diapers, strollers and cribs. So that could be pretty significant for folks, particular for folks that have pampers tax free families. Finally, pampers tax free, the governor wants a one-year pieluchomajtki medium 7 tax exemption on all pet food and over-the-counter pet medications. DeSantis is also aiming to expand Florida's annual back-to-school sales tax holiday to a total of four weeks next year, with two weeks of tax breaks leading into the fall semester and two weeks leading into the spring semester. The sweeping proposal is an extension of a major tax relief plan that's currently in effect for Florida families. Children's diapers, as well as clothing and shoes for kids who are 5 and under, are tax-free until June 30, The Florida Legislature will need to approve this massive tax break package in next year's legislative session — which is scheduled to pampers tax free from March 7 to May 5 — before it can become a reality.

Pampers tax free. Pampers Club Loyalty Program Terms and Conditions

Membership in the Loyalty Program is only open to individuals who are legal residents of the fifty 50 United States and the District of Columbia, and Puerto Rico, who pampers tax free the age of majority in the jurisdiction that they live as of the date of enrollment and have the capacity to enter into a binding contract. The Loyalty Program is void elsewhere and where prohibited. Corporations or other entities or organizations of any kind are not eligible for the Loyalty Program. Please pampers tax free our Privacy Policy at www. While registering, you must accept these Terms, after which registration is complete. By participating in the Loyalty Pieluchy 5 mala paczka, each Member is responsible for maintaining the confidentiality of his or her Pampers Cash Account and password and for restricting access to his or her computer or mobile device. Member agrees to accept responsibility for all activities that occur under Member's Pampers Cash Account or password. Earning Pampers Cash. Members earn Pampers Cash for qualifying purchases of Pampers diapers, training pants, and wipes products. Pampers Cash has no monetary value. Beginning a. EDT June 7, and ending p. Pampers Cash is only redeemable via Pampers Club and has no monetary value, pampers tax free. Each qualifying product will have a Code inside the package. For boxes containing multiple bags, each bag will have a Code inside the package and Members will need to scan all Codes to get the total amount of Pampers Cash for the box.

You are here

Legislators have approved a tax on diapers and rejected a proposal to exempt payment of taxes on adult diapers. The Bill proposed exemption on payment of tax on adult diapers but the Members of Parliament put up a spirited fight against the proposal. Shadow Minister of Finance, Hon. He instead proposed that all diapers should be exempted from payment of VAT.

Wine shipping tax rates Find DTC wine shipping tax rates and rules by state. Restaurants A fully automated sales tax solution for the restaurant industry.

Diapers now exempt from sales tax in Ohio: See which other baby products are also included

Choice at you hard